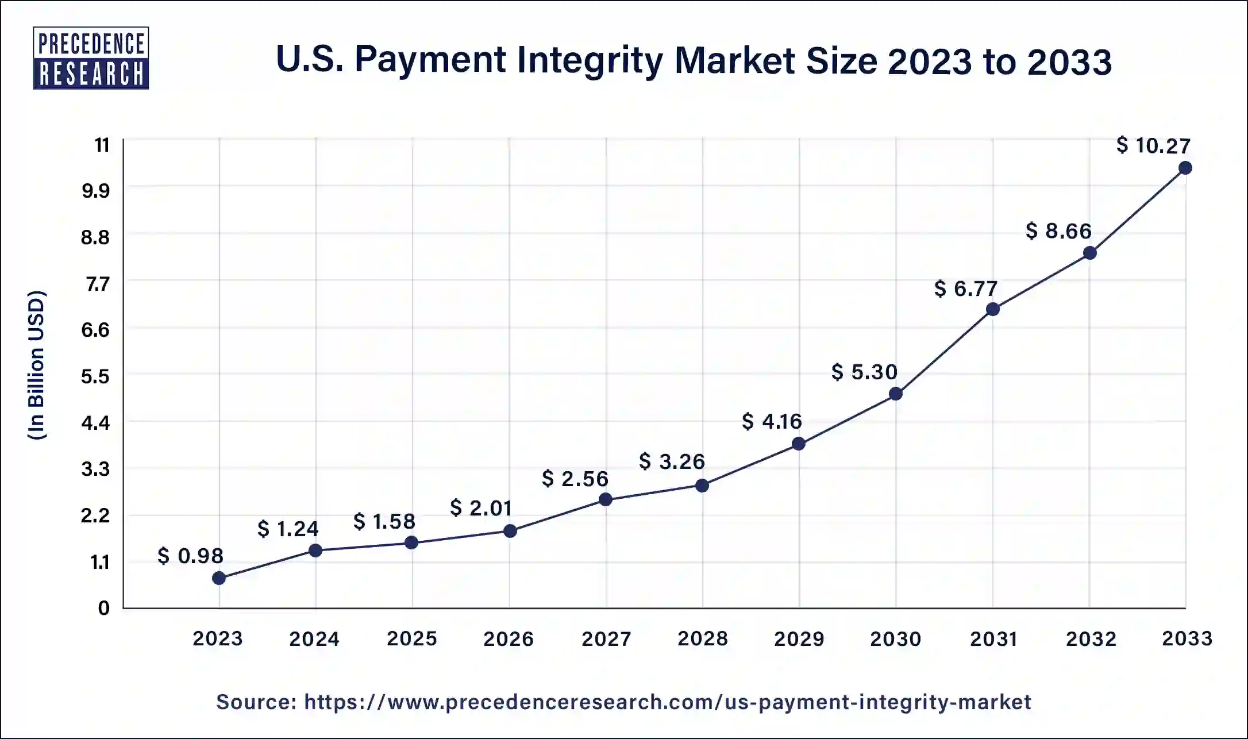

U.S. Payment Integrity Market Size Expected to Reach USD 10.27 Billion by 2033

The U.S. payment integrity market size is calculated at USD 1.24 billion in 2024 and is expected to reach around USD 10.27 billion by 2033, expanding at a double digit CAGR of 26% from 2024 to 2033.

/EIN News/ -- Ottawa, July 17, 2024 (GLOBE NEWSWIRE) -- The U.S. payment integrity market size is predicted to increase from USD 0.98 billion in 2023 to approximately USD 10.27 billion by 2033, According to Precedence Research. The U.S. payment integrity market is driven by rising healthcare infrastructure, increasing fraud cases, and government initiatives.

Payment integrity is critical for healthcare providers because it ensures accurate and timely compensation. The National Healthcare Anti-Fraud Association estimates that healthcare fraud costs around 3% of overall healthcare expenses. Payment integrity programs target fraud and inefficient billing practices, such as accurate party identification, membership eligibility, and contractual compliance.

Providers must be aware of payers' attempts to combat fraud and compliance concerns. Ensuring payment integrity requires robust documentation and coding processes, as well as education. Clear documentation rules, documentation templates in electronic health records (EHR), and computer-assisted coding systems can all aid with coding procedures.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/3060

U.S. Payment Integrity Market Revenue (USD Million) 2022-2032, By Component

| By Component | 2022 | 2023 | 2027 | 2032 |

| Software | 486.52 | 618.38 | 1,626.54 | 5,545.27 |

| Services | 285.74 | 361.62 | 934.94 | 3,119.22 |

U.S. Payment Integrity Market Revenue (USD Million) 2022-2032, By Function

| By Function | 2022 | 2023 | 2027 | 2032 |

| Query & Reporting | 270.29 | 342.51 | 890.11 | 2,989.25 |

| OLAP & Visualization | 308.9 | 392.98 | 1,037.4 | 3,552.44 |

| Performance Management | 193.07 | 244.51 | 633.97 | 2,122.8 |

U.S. Payment Integrity Market Revenue (USD Million) 2022-2032, By Application

| By Application | 2022 | 2023 | 2027 | 2032 |

| Pre-payment | 193.07 | 247.94 | 678.79 | 2,426.06 |

| Post-payment | 386.13 | 488.04 | 1,255.12 | 4,158.95 |

| FWA | 154.45 | 195.51 | 505.89 | 1,689.58 |

| Others | 38.61 | 48.51 | 121.67 | 389.9 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3060

U.S. Payment Integrity Market Key Insights

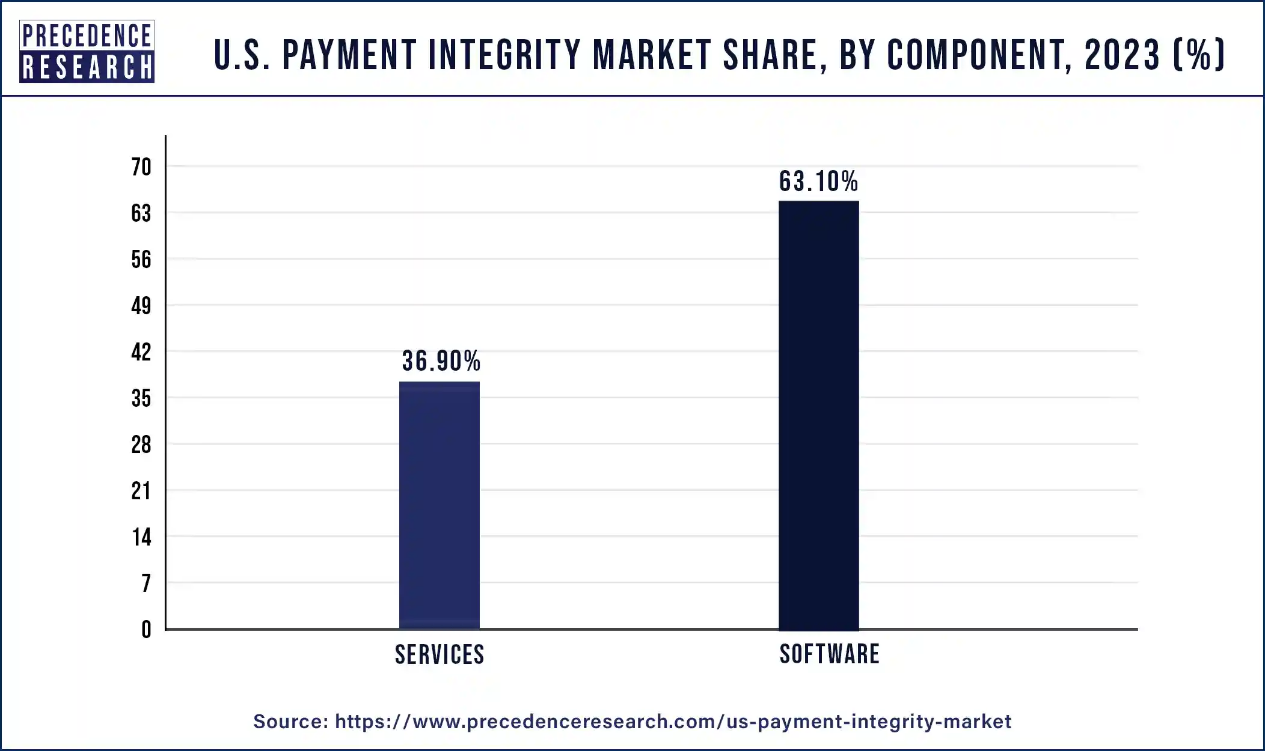

- By component, the software segment has held a major revenue share of 63.10% in 2023.

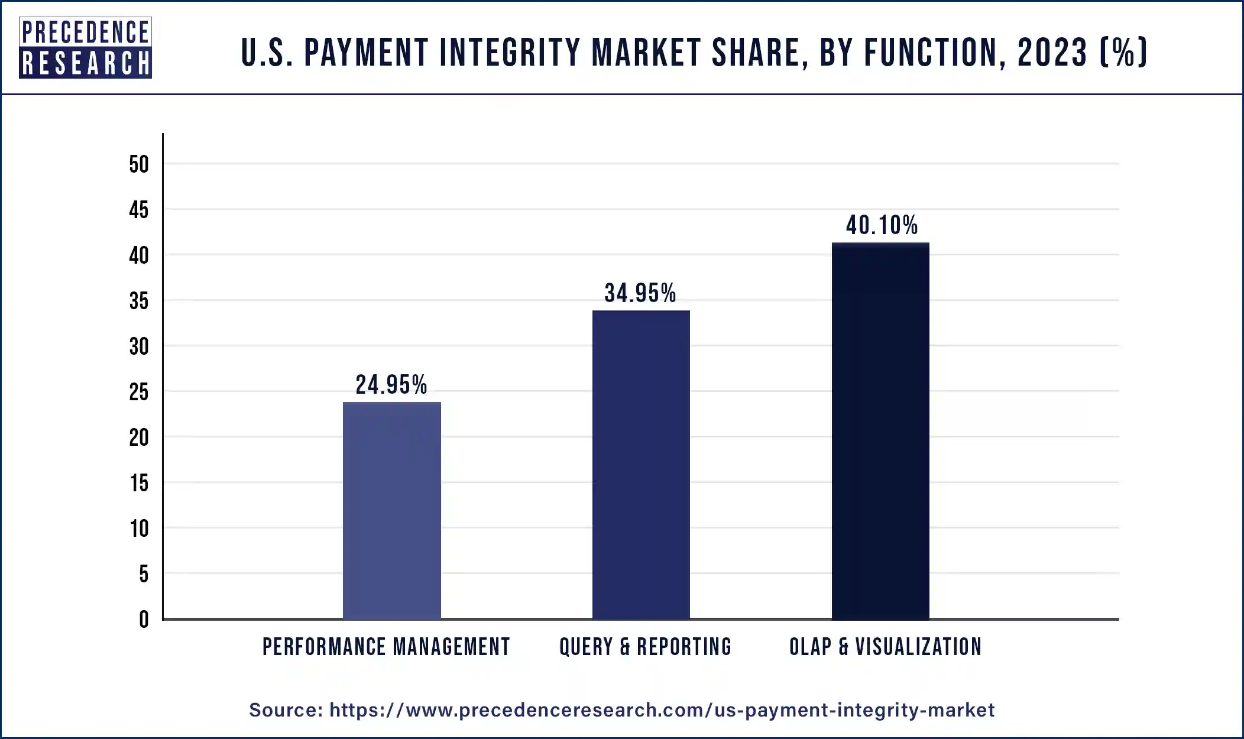

- By function, the OLAP & visualization segment has contributed 40.10% of revenue share in 2023.

- By application, the post-payment segment has recorded the largest revenue share of 49.80% in 2023.

- By mode of delivery, the on-premises segment has generated more than 55.95% of revenue share in 2023.

- By end-use, the healthcare providers segment has captured more than 64.75% of revenue share in 2023.

U.S. Payment Integrity Market Coverage

| Report Attribute | Key Statistics |

| Market Size by 2033 | USD 10.27 Billion |

| Market Size in 2024 | USD 1.24 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 26% |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Year | 2024-2033 |

| Segments Covered | By Component, By Function, By Application, By Mode of Delivery, and By End Use |

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

U.S. Payment Integrity Market Segments Outlook

Component Outlook

The software segment dominated the U.S. payment integrity market in 2023. Payment integrity (PI) is critical in US healthcare, as it ensures accurate claims adjunction and appropriate compensation for service delivery. To address basic problems and examine difficult situations, software and analytics technologies, as well as coding specialists and medics, are used. Services are delivered by corporate health plan departments and specialist PI businesses.

Payment processing software automates transactions on different platforms by connecting with shopping carts, accounting software, and customer relationship management systems. The market is competitive, with several high-quality solutions, necessitating careful evaluation of unique company requirements when picking a platform.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/3060

Function Outlook

The OLAP & visualization segment dominated the U.S. payment integrity market in 2023. Online analytical processing (OLAP) provides data engineers and analysts with five major advantages: better decision-making, increased data visualization, time savings, flexibility, and a competitive edge. There are three types of OLAP systems: multidimensional (MOLAP), relation (ROLAP), and hybrid (HOLAP). ROLAP systems employ relational databases for data storage and SQL queries, but MOLAP stores data in a multidimensional cube structure that allows for complicated computations and aggregations.

HOLAP combines the best features of both systems, allowing users to store summary data in multidimensional cubes and specific business data in a relational database. The type of OLAP system used is determined by the organization’s unique analytical requirements, such as data complexity, query response time, and analysis and reporting.

Application Outlook

The post-payment segment dominated the U.S. payment integrity market in 2023. Post-payment changes are critical for ensuring compliance and accuracy in healthcare reimbursement. They include thorough audits, payment reconciliation, benefits coordination, subrogation, and overpayment recovery. These procedures assist in detecting fraud, ensuring genuine claims, preventing financial overlaps, and ensuring appropriate reimbursement from providers.

Mode of Delivery Outlook

The on-premises segment dominated the U.S. payment integrity market in 2023. On-premises is a conventional approach to delivering and maintaining hardware and software on a company’s premises. It provides total control over IT infrastructure, customization, and local data storage, especially for sensitive or secret information. It also allows for faster access to data.

On-premises software, on the other hand, can be expensive to implement and maintain since it requires hardware and software licensing. Scaling up on-premises infrastructure may be difficult and time-consuming. Despite these issues, on-premises software is still a viable choice for firms that can afford to acquire and maintain licenses.

End Use Outlook

The healthcare providers segment dominated the U.S. payment integrity market in 2023. Payment integrity in healthcare is a method that seeks to detect faults, duplication, and inconsistencies that patients would have paid for, resulting in cost-cutting solutions. It also tries to stop unfair invoicing practices in the future.

Despite industry customs, payment integrity prioritizes accountability over convention. It seeks to restore the balance of power to some semblance of equality, notwithstanding the seeming extreme upheaval caused by minor administrative adjustments.

Browse More Insights:

-

Asset Integrity Management Market Size and Forecast: The global asset integrity management market size accounted for USD 23.16 billion in 2022 and it is projected to hit around USD 38.75 billion by 2032, growing at a CAGR of 5.28% during the forecast period 2023 to 2032.

-

B2B Payments Transaction Market Size and Forecast: The global B2B payments transaction market size was valued at USD 1.41 trillion in 2023 and is anticipated to reach around USD 3.53 trillion by 2033, growing at a CAGR of 9.39% from 2024 to 2033.

-

Payment Processing Solutions Market Size and Forecast: The global payment processing solutions market size was estimated at USD 100 billion in 2022 and is expected to surpass around USD 632.18 billion by 2032 with a remarkable CAGR of 20.3% from 2023 to 2032.

-

Payment Security Market Size and Forecast: The global payment security market size was valued at USD 25.90 billion in 2023 and is anticipated to reach around USD 95.35 billion by 2033, growing at a CAGR of 13.92% from 2024 to 2033.

-

Predictive Analytics Market Size and Forecast: The global predictive analytics market size was valued at USD 10.2 billion in 2022, and it is expected to hit at around USD 67.86 billion by 2032 with a registered compound annual growth rate (CAGR) of 21.4% during the forecast period 2023 to 2032.

-

5G Services Market Size and Forecast: The global 5G services market size was estimated at US$ 64.54 billion in 2021 and is expected to hit around US$ 1.87 trillion by 2030, poised to grow at a CAGR of 44.63% during the forecast period 2022 to 2030.

-

Geospatial Analytics Market Size and Forecast: The global geospatial analytics market size was estimated at USD 71.38 billion in 2022 and is expected to hit around USD 261.15 billion by 2032 with a registered CAGR of 13.9% during the forecast period 2023 to 2032.

-

Cloud-based Contact Center Market Size and Forecast: The global cloud-based contact center market size surpassed USD 29.63 billion in 2023 and is estimated to hit around USD 155.74 billion by 2033 with a double-digit CAGR of 18.05% from 2024 to 2033.

-

Artificial Intelligence (AI) Market Size and Forecast: The global artificial intelligence (AI) market size was valued at USD 538.13 billion in 2023 and is expected to hit around USD 2,575.16 billion by 2032, progressing with a compound annual growth rate (CAGR) of 19% from 2023 to 2032.

U.S. Payment Integrity Market Dynamics

Drivers

Cost savings

Payment integrity can result in significant cost reduction by reducing fraudulent claims, billing mistakes, and inefficient practices. This can cut wasteful spending by 8% to 10% or more, guaranteeing effective resource allocation and high-quality patient care. Healthcare fraud costs the US tens of billions of dollars every year. Advanced data analytics and predictive modeling can assist payers in detecting and preventing fraudulent activity, leading to considerable cost savings.

Enhanced provider-payer relationship

Payment integrity solutions help healthcare providers and payers build stronger relationships by offering clear rules and instructional materials. This partnership speeds claim processing, lowers mistakes, and increases efficiency.

Providers who understand payment integrity submit more accurate claims, which reduces the need for adults and appeals. This results in speedier reimbursement and more dependable care, which benefits patients by assuring timely access to high-quality care, boosting the growth of the U.S. payment integrity market.

Restraint

Billing errors

Payment integrity is difficult to maintain owing to billing errors and erroneous claims caused by coding errors, paperwork discrepancies, or misconceptions of reimbursement criteria. These mistakes might cause healthcare providers to be overpaid or underpaid, resulting in financial inaccuracies and conflicts.

Inefficiencies in claims processing, such as manual processes, a lack of defined protocols, and complex reimbursement systems, can also cause delays, mistakes, and higher administrative expenses, affecting the entire healthcare payment ecosystem.

Opportunity

AI-based technology

Payment integrity is evolving toward prepaid solutions and AI-powered interventions, with the latter used earlier in the claim lifecycle to save costs. As the complexity of payment integrity solutions increases, health plans will need platform-based techniques to easily integrate and model the impact of varied capabilities. In terms of product design and deployment tactics, successful suppliers promote flexibility and customer-centricity.

Advanced Large Language Models can transform payment integrity and patient engagement by facilitating more natural interactions and individualized support. The confluence of AI and prepay editing solutions is resulting in unparalleled accuracy, value development, and transparency throughout the healthcare industry. Technology partners will play an important role in simplifying the business of care and allowing more efficient, effective, and equitable healthcare.

U.S. Payment Integrity Market Top Companies

- Cotiviti

- Availity

- Cognizant

- EXL

- HealthEdge

- Syrtis

- Zelis

- ClaimLogiq

- Varis

- Performant

- Rialtic

- MultiPlan

- Optum / Change Healthcare

- ClarisHealth

- Ceris

Recent Developments:

-

In May 2024, Penstock Group obtained HITRUST accreditation for ClearBridge, their SaaS payment integrity solution. ClearBridge's two-year accreditation indicates compliance with regulatory and industry requirements, as well as risk management. This accreditation ranks Penstock among the few global firms that have obtained it, proving the HITRUST Assurance Program's rigorous security measures.

-

In May 2024, Zelis, a prominent healthcare technology supplier, launched the Zelis Advanced Payments Platform (ZAPP) to help simplify the processing of large amounts of claims payments and technical needs. The platform intends to streamline operations, decrease complexity, and assure compliance with technology, regulatory requirements, and customer expectations, all while offering a payment experience that caters to both providers and members.

Segments Covered in the Report:

By Component

- Software

- Services

By Function

- Query & Reporting

- OLAP & Visualization

- Performance Management

By Application

- Pre-Payment

- Claims Editing (1st pass)

- Claims Editing (2nd, 3rd, etc.)

- Coding Validation

- Post-Payment

- Complex/Clinical Provider Audit

- Coordination of Benefits (COB)

- Subrogation

- Data Mining

- FWA

- Provider Fraud, Waste & Abuse

- Special Investigations

- Others

- Reporting and Analytics

- Others

By Mode of Delivery

- On-Premises

- Cloud-Based

- Hybrid

By End Use

- Payers

- Healthcare Providers

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/3060

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us:

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.